All Categories

Featured

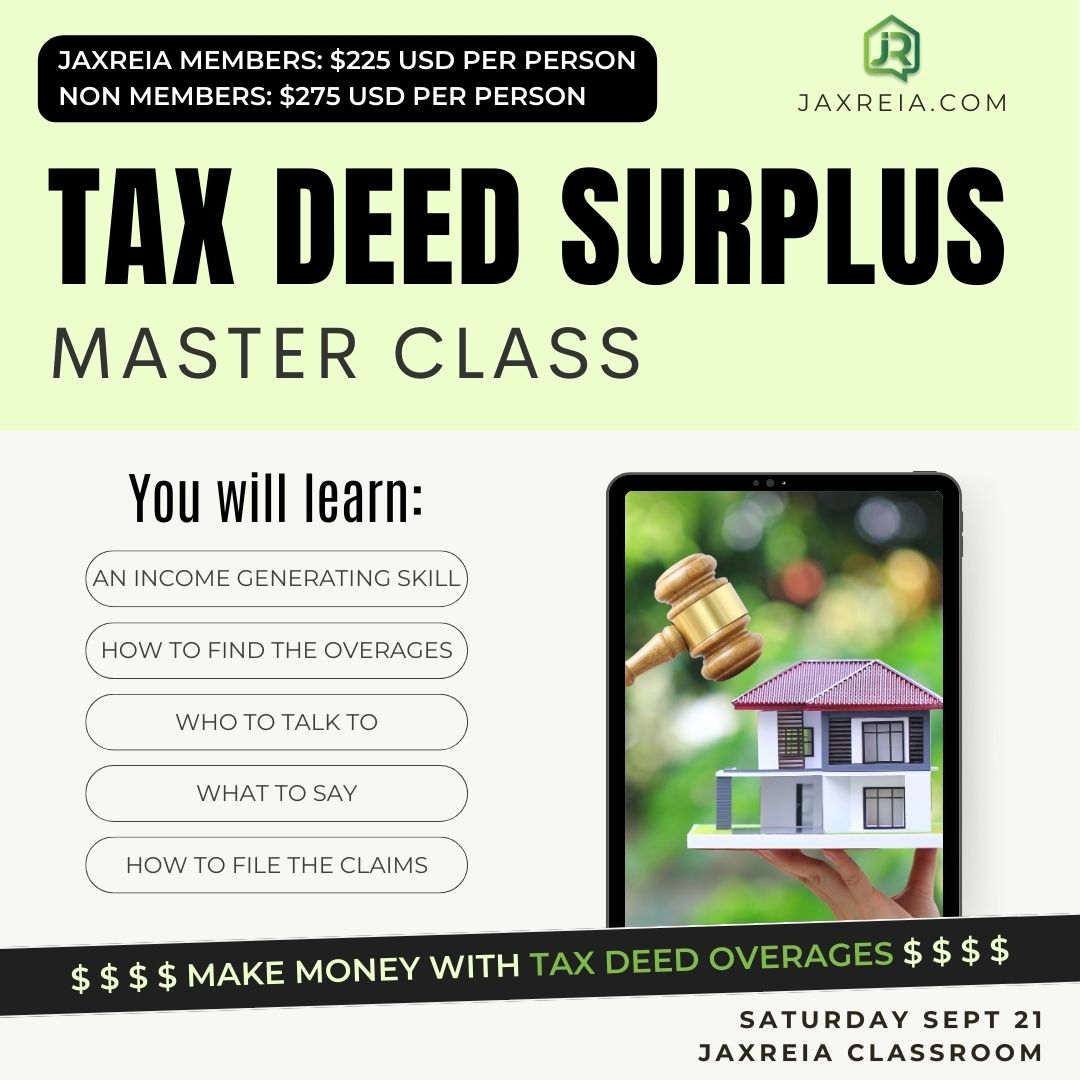

If the home owner does not pay their residential property tax obligations, there can be a Tax Repossession by the neighborhood county and if that building goes to Tax Foreclosure auction, there is commonly a prospective buyer that gets the home for greater than what was owed in real estate tax. Allow me explain # 2 for you a little much deeper claim you owe $15,000 in home tax obligations on your house and your residential property goes right into Tax obligation Foreclosure.

Say the property sells for $100,000 and from that, the area takes their $15,000 they were owed for property tax. Foreclosure Overages. So what occurs to the continuing to be $85,000 that the clerk of court has in their savings account? The property owner needs to make a case to the area clerk and the court usually reviews these cases and honors the homeowner his cash

The county federal government HAS NO Responsibility to inform or inform the previous property owner. J.P. Morgan claims these Tax obligation Repossession sales create nearly 13.6 million dollars in overages, or equity, every single day.

Reputable Tax Sale Overage List Training Tax And Mortgage Overages

My good pal, Bob Diamond, is an expert in this niche of overages and assists home owners get the cash that's due to them. He simply recently informed me that they currently have 2.2 million bucks in overages under contract in his office and they will certainly receive charges of around 30% of that 2.2 million.

There are a couple of points you will certainly require to be successful in the excess company. Right here are the four easy steps you will certainly need to adhere to: Figure out who is owed the money and that to get a targeted checklist. Tax and Mortgage Overages. Because Bob is an attorney, he knows exactly how to get the list needed to discover these previous home owners

That's unbelievable? The excess market is a fantastic area for a property rookie to start their career. These finder's costs amount to an extremely wonderful revenue for anybody putting a permanent initiative. Mortgage Foreclosure Overages. Start with tax obligation sale excess, and afterwards function your means approximately extra challenging funds like home loan foreclosure overages and unclaimed estates.

This is likewise a fantastic way for a person who does not wish to deal houses anymore to remain in the actual estate market without getting their hands as well unclean. Bob describes this as the "Robin Hood System" and if you think of, this name completely makes feeling. There is a considerable quantity of cash in it for YOU as an insider that would be discovering this cash for individuals from the federal government.

Latest Posts

Investing In Real Estate Tax Liens & Deeds

Delinquent Property Tax Auction Near Me

Homes For Sale For Taxes Owed